By Todd Taylor and Jeremy Kalin

Elon Musk is a busy guy. Tesla. SpaceX. The Boring Company. Going to Mars. Setting up Hyperloop. Selling flamethrowers and raising his son “X Æ A-12.”

Now, Elon has offered up to $100 million as part of the XPrize competition for carbon capture startups.

Capturing carbon has captured the attention of governments, corporations, startups and investors who see it as a Mars-shot – to not only capture ongoing carbon emissions but also start to build a carbon sink, helping mitigate future climate problems resulting from too much carbon in the atmosphere.

While its exciting to see Venture Capital paying attention to carbon capture technologies and companies, carbon capture efforts have required intensive capital – not a space where VC investors like to play, traditionally.

Carbon capture projects also face political uncertainty and long paybacks, thanks to high capital costs and lower payment streams – more typical of infrastructure projects than high-growth tech companies.

It’s not easy to figure out a business model around carbon capture. Other than getting financial incentive payments or significant tax credits from storing CO2 underground, there are not yet many markets with high enough prices to justify the high capital cost.

Direct-air capture could help create a CO2 deficit against past CO2 emissions; the proposition has captured the imagination and attention of some governments and large corporations. Most of these direct-air capture technologies rely on subsidies and stable political and regulatory structures, like other carbon capture technologies we’ve seen come and go before.

But if VC-backed companies have successfully transformed other traditional industries like medicine, finance and education, maybe entrepreneurs can make a similar impact when it comes to capturing carbon. A lot of startups are taking a crack at it – creating business models that do not rely on government subsidies.

But the CO2 capture industry hasn’t received the same attention as VC-backed EV companies – at least not yet. Most CO2 investment has been driven by oil companies, utilities, large carbon intense industries, and governments. Most of these projects have been tied into existing very expensive infrastructure and even the large CAPEX of CO2 capture projects is small by comparison.

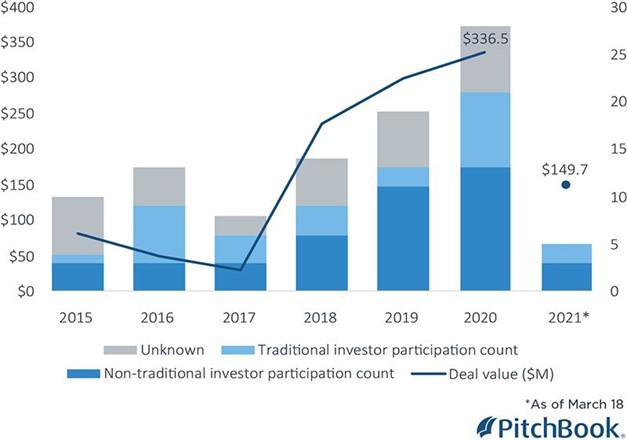

Carbon capture VC deals, global

Many of those projects may never see a positive financial return…and likely were never designed or expected to do so.

Some recent promising trends in the carbon capture space include companies that do more than just capture carbon, by utilizing the carbon to create products or secondary uses with monetizable value to other companies or directly to consumers. These additional products or secondary uses can add revenue streams to create a positive financial return more in line with normal VC guidelines.

To do this, startups need to find high-carbon-intensity industrial partners who see the benefit of reducing their CO2 emissions and are willing to participate in developing new technologies. Once this simple task is accomplished, startups need to ensure they are developing products that have actual customer demand. Other “green” VC backed companies have failed to create viable business models and have paid the price.

Startups are going to have to harness the risk taking of VC’s with the strategic imperative of industry partners to create solutions to reduce, remove and recycle carbon from the supply chain and atmosphere. Trillions of dollars of long-term investment may be needed, which translates into huge opportunities for those willing to meet the challenges.

Impact Counsel at Avisen Legal loves working with companies and investors that are stepping up to these challenges. If we can help, contact Todd Taylor or Jeremy Kalin and lets change the world.